Why having no credit is risky is something many responsible people don’t understand until they are denied an apartment, a credit card, or a basic loan.

Watch the video tutorial below.

When Doing Everything “Right” Still Gets You Denied

You paid your rent on time.

You avoided debt.

You used your debit card and saved your money.

And you still got denied.

That moment feels backwards, confusing, and unfair.

But it is not random.

The Real Problem Isn’t Responsibility — It’s Visibility

The problem is not that you did something wrong.

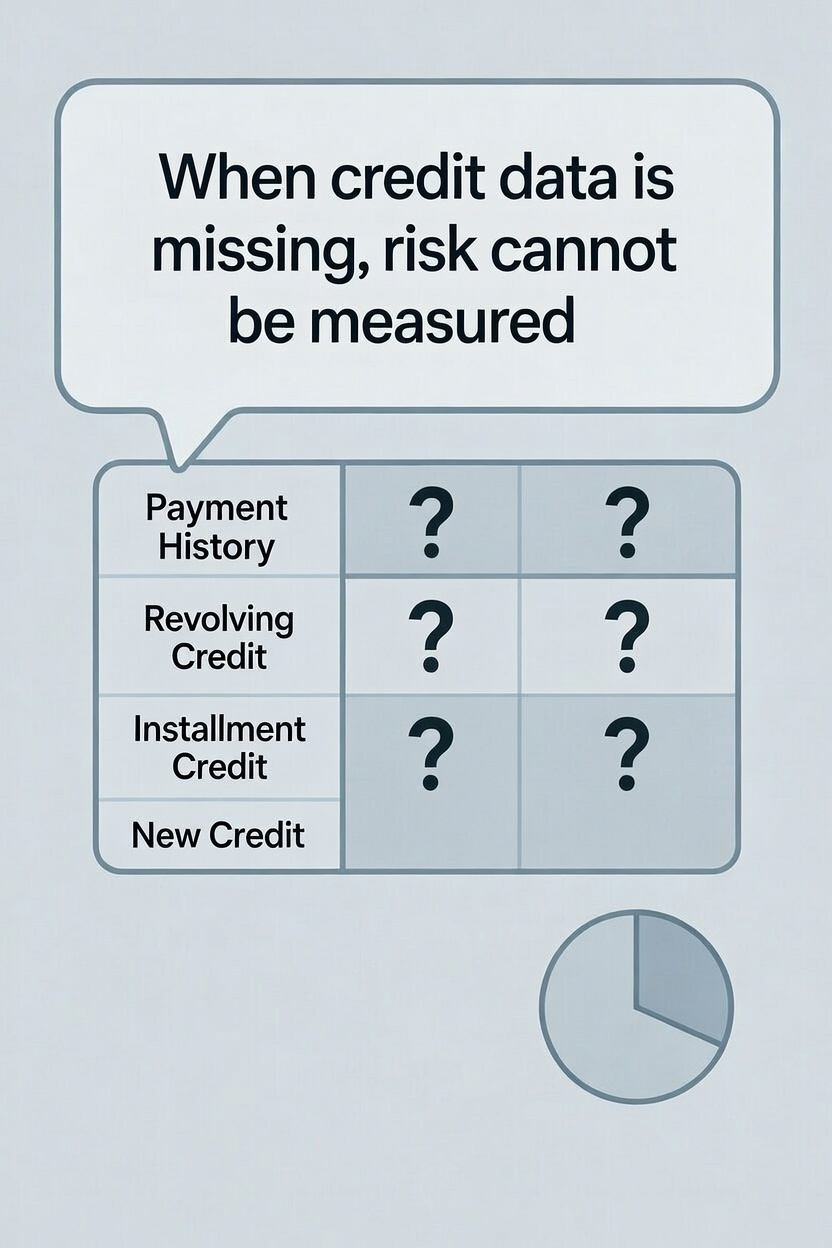

The problem is that no credit is unreadable to lenders.

When your credit file is empty or too thin, automated systems cannot evaluate risk.

And when risk cannot be measured, the system defaults to denial.

This is where many beginners confuse effort with outcomes.

Lenders are not evaluating character.

They are evaluating what shows up inside the credit profile, not just whether bills were paid.

If this distinction feels subtle, it becomes clearer when you understand the difference between a score and the underlying file, which is explained more fully in Credit profile vs credit score explained.

Why Credit Systems Don’t Reward “Good Behavior” Alone

Credit systems were not built to reward responsibility.

They were built to predict repayment behavior.

Lenders rely on standardized, reportable data.

That data comes from accounts that show borrowing, usage, and repayment over time.

Debit cards do not show borrowing.

Savings accounts do not show repayment under obligation.

Rent and utilities are inconsistent in how they are reported.

So even if you are financially responsible, your behavior never reaches the credit model.

From an underwriting perspective, no data is not neutral.

No data is treated as unknown risk.

This is why lenders do more than just look at the score itself. They evaluate structure, patterns, and consistency. These are the same factors discussed in [What lenders actually look at beyond your score].

The Assumptions That Quietly Work Against You

Most people believe credit works like a character reference.

If you are careful, disciplined, and debt-free, it should trust you.

That assumption leads to three common mistakes:

- Thinking debit card use builds credit

- Avoiding all credit for too long

- Waiting to build credit until it is “needed”

The framework does not reward intent.

It only responds to patterns it can measure.

Why an Empty or Thin File Fails Faster Than a Messy One

Credit is not a score about you.

It is a risk model about future behavior.

A thin or invisible credit file fails not because it is bad, but because it is incomplete.

Lenders cannot confirm how you handle repayment when money is borrowed under terms.

This is the reason someone with an older credit file and a single minor mistake can sometimes be approved faster. It happens compared to someone with no history at all.

The system prefers known risk over unknown risk.

That same dynamic shows up repeatedly in approvals and denials, especially when profiles lack depth, which is explored further in [How thin credit files affect approvals].

This does not mean you should rush into debt.

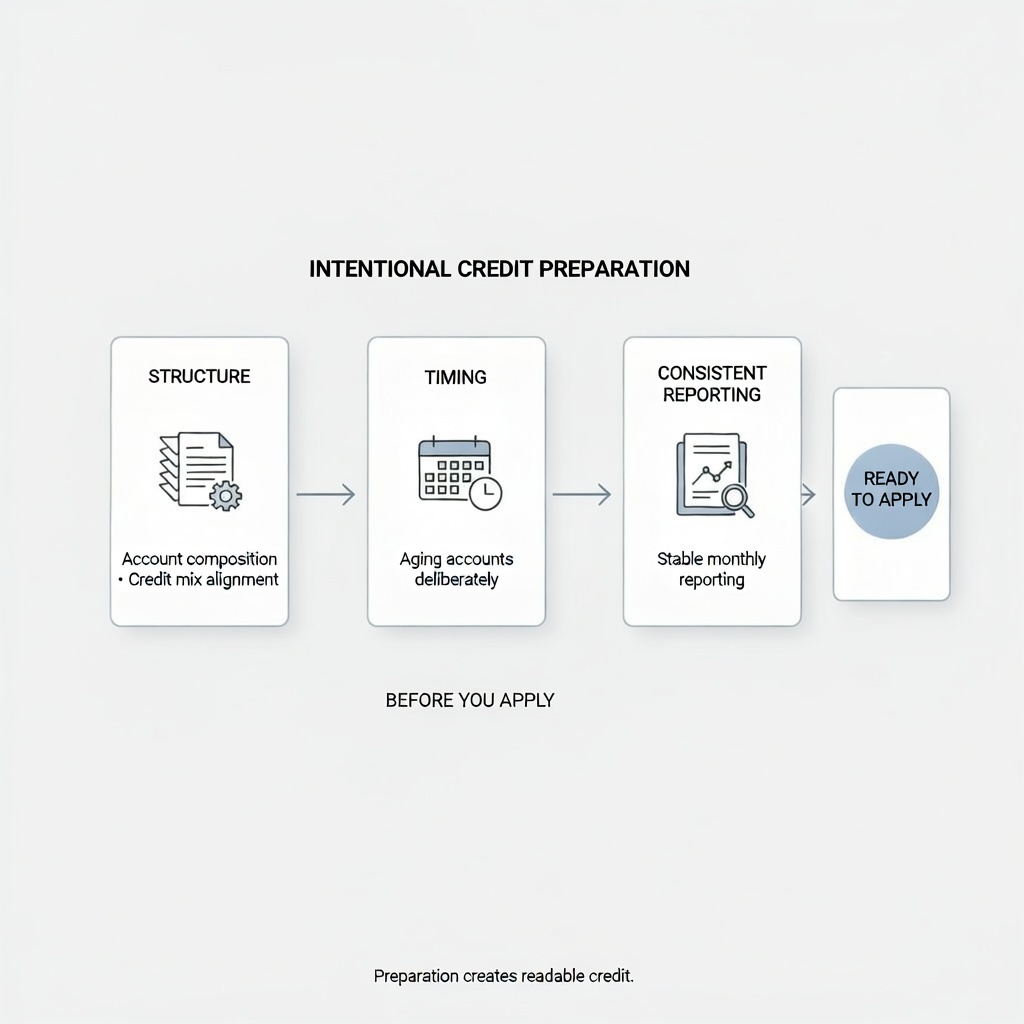

It means credit needs to be intentionally built before it is required.

Becoming Credit-Readable Before You Need Approval

The goal is not to “get a score fast.”

The goal is to become credit-readable.

That starts with understanding timing.

It continues with choosing accounts that report consistently.

And it requires patience while patterns are established.

Building credit early, calmly, and deliberately protects future options.

Waiting until a denial forces action usually leads to rushed decisions and weaker outcomes.