The answer has less to do with your score and more to do with timing, structure, and risk alignment.

What lenders look at beyond your credit score is often the missing piece when everything looks fine on paper and the decision still comes back as a no.

When “Good Credit” Still Doesn’t Work

You check your credit score.

It’s good.

Sometimes even very good.

You apply anyway, expecting a smooth process.

Instead, you get denied.

Or approved for a much smaller limit than expected.

Or told to wait, with no clear explanation.

That moment feels frustrating because it doesn’t line up with what you’ve been taught.

A good score is supposed to mean access.

It’s supposed to mean approvals come easier.

So when that doesn’t happen, most people assume something is wrong.

With the lender.

With the system.

Or with their credit report.

In reality, the issue is usually how the credit profile is being evaluated in that moment, not whether the score itself is “good enough.”

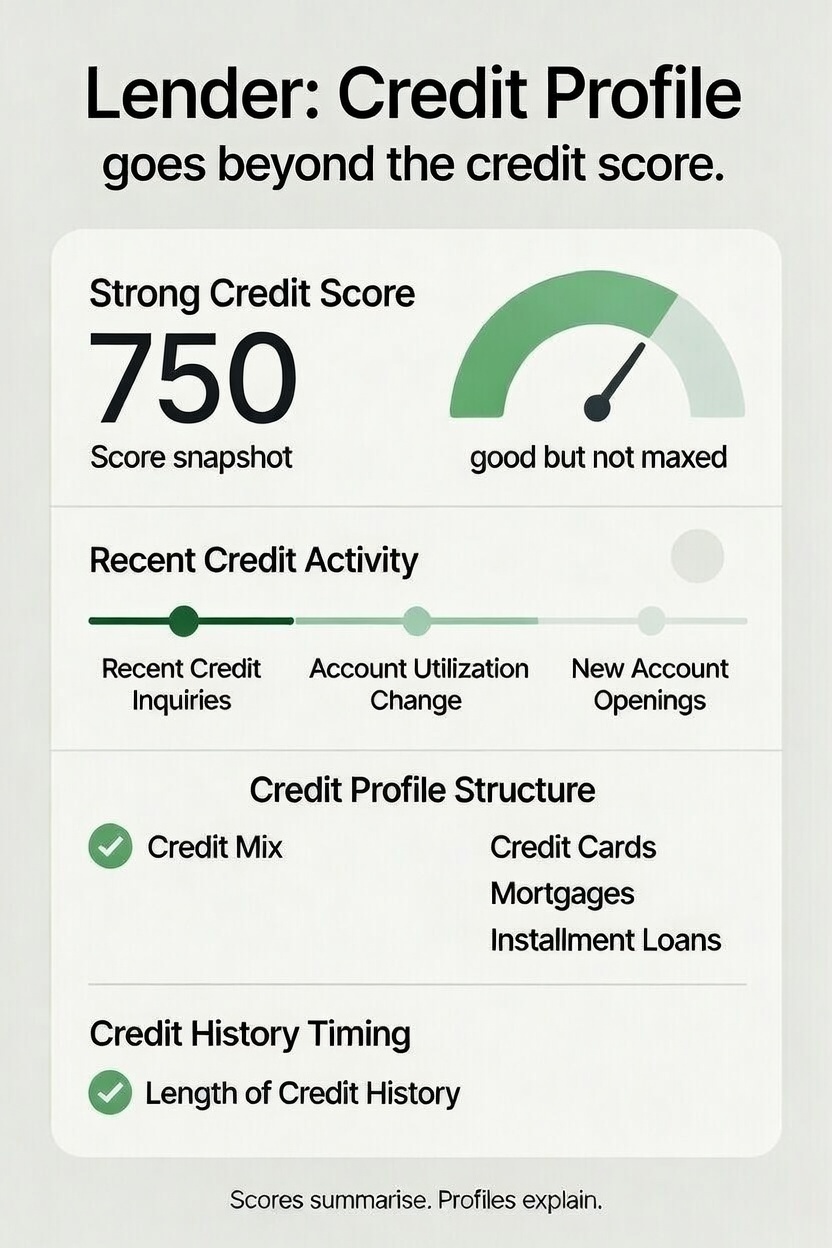

Your Credit Score Is a Signal, Not the Decision

A credit score is a shortcut.

It helps lenders quickly sort applications into broad risk categories.

It does not decide approvals on its own.

Lenders approve based on your credit profile, not just the number attached to it.

The profile shows repayment history, account behavior, consistency, and how predictable your risk looks right now.

That distinction becomes even clearer once you understand the difference between surface signals and deeper evaluation, which is explored further in Credit Profile vs Credit Score Explained.

That’s why two people with similar scores can get very different outcomes.

The score opens the door.

The profile determines whether the application moves forward.

How Lenders Actually Review Credit Profiles

Credit decisions happen in layers.

The early review looks at surface-level signals.

That’s where the score matters most.

Later reviews look deeper.

This is where lenders evaluate the credit profile as a whole.

They look at how repayment history shows up across accounts.

They look at whether activity has been steady or uneven.

They look at how recent changes compare to the type of credit being requested.

Repayment history matters, but it doesn’t stand alone.

It lives inside the broader credit profile.

A profile can show years of on-time payments and still raise concerns if recent behavior doesn’t align with the decision being made.

That’s not punishment.

That’s risk assessment.

This layered review process is also why limited or incomplete files often struggle in later stages, a pattern broken down in How Thin Credit Files Affect Approvals.

What “Beyond Your Score” Really Means

When people hear that lenders look beyond the score, they often picture a checklist.

That’s not how decisions actually work.

Lenders weigh signals together.

They look at how different parts of the credit profile interact.

They care about capacity, consistency, and stability in context.

Not in theory.

In real time.

This is why approvals don’t hinge on one factor.

It’s also why strong scores sometimes fail to carry an application on their own.

Why the Last 12–24 Months Matter So Much

Lenders do look back.

Often 12 months.

Sometimes 24 months or longer.

But they don’t treat all history equally.

Older behavior provides background.

Recent behavior drives decisions.

If recent activity suggests rising risk, misalignment, or uncertainty, it can outweigh older positives.

That doesn’t erase your history.

It changes how it’s interpreted.

This is where timing becomes critical.

A credit profile can be strong overall and still struggle if recent signals don’t match the type of approval being requested.

Where Most People Misread Their Credit Strength

This is where reasonable assumptions start working against people.

- “My score has been good for years, so I should qualify.”

- “I haven’t applied in a long time, so that should help.”

- “Low balances automatically mean low risk.”

- “If I was pre-approved, the hard part is done.”

None of these ideas are careless.

They’re just incomplete.

Most people don’t get denied because of bad behavior.

They get denied because their credit profile isn’t positioned for that decision at that moment.

This same misunderstanding shows up earlier for people who avoided credit altogether, which is why Why Having No Credit Is Risky explains how unreadable profiles can fail before scores even matter.

What Lenders Consider That Doesn’t Show Up in a Score

Credit scores summarize what has already happened.

They don’t capture everything lenders need to assess risk.

Lenders also evaluate information connected to your application itself.

Income context.

Debt obligations.

Stability signals.

How your reported credit aligns with what you’re asking for.

This doesn’t replace your credit history.

It adds another layer to how the profile is interpreted.

That’s why someone with a good score can still face hesitation.

The score isn’t being ignored.

It’s being placed in context.

Approvals Are About Alignment, Not Perfection

This is the shift that makes credit decisions make sense.

Lenders aren’t asking whether you’re good with credit.

They’re asking whether your credit profile aligns with this decision right now.

Alignment includes repayment history.

It also includes structure, timing, recent activity, and predictability.

When those pieces line up, approvals feel smoother.

When they don’t, the score alone can’t do the heavy lifting.

That’s why good credit doesn’t always translate into immediate access.

And why understanding how lenders read profiles matters more than chasing a higher number.

What to Think About Before Applying Again

The takeaway isn’t to stop using credit.

And it isn’t to apply everywhere until something sticks.

It’s to pause and look at your credit profile as a whole.

Not just the score attached to it.

Understanding what lenders look at besides your credit score helps you move from reacting to preparing.

From guessing to positioning.

That’s how credit decisions stop feeling unpredictable.

And that’s how approvals become easier to anticipate.

Related Topics to Read Next

These posts expand on the ideas above and help you see how lenders evaluate credit in stages:

- Why Having No Credit Is Risky — explains why empty or unreadable profiles often fail before scores even matter.

- How Thin Credit Files Affect Approvals — breaks down why limited credit history can block approvals even with a decent score.

- Credit Profile vs Credit Score Explained — clarifies the difference between the number you see and the behavior lenders evaluate.

Good credit getting denied isn’t a contradiction.

It’s usually a signal that the credit profile and the timing don’t match yet.

And understanding what lenders look at beyond your credit score is what allows you to position your credit profile with clarity instead of confusion.