Credit score vs credit profile is one of the most misunderstood concepts for beginners trying to make sense of approvals.

If you have ever wondered why someone with a “good score” still gets denied, you are not missing something obvious.

You are missing context.

Most beginner education focuses on scores because they are easy to see and easy to track.

Approvals, however, are not based on a single number.

This confusion leads people to take actions that improve a score while quietly weakening their approval strength.

This article explains the difference in plain English and reframes what “good credit” actually means when lenders evaluate risk.

Credit Score vs Credit Profile and Why Scores Feel Like the Whole Story

Credit score vs credit profile confusion starts because the score is the most visible part of credit.

It updates regularly.

It is easy to monitor.

It gives the illusion of control.

A credit score is a summary metric.

It reflects patterns, not decisions.

Lenders use it as a screening tool, not a final verdict.

The real evaluation happens inside the credit profile.

When beginners focus only on the score, they miss the structure underneath it.

That structure is what determines approvals.

This is also why people with solid scores are sometimes surprised by denials, limits, or mixed results—an experience explored more directly in [Why good credit scores still get denied].

Credit Score vs Credit Profile Explained in Simple Terms

Credit score vs credit profile can be simplified like this.

Your credit score is a snapshot.

Your credit profile is the full file.

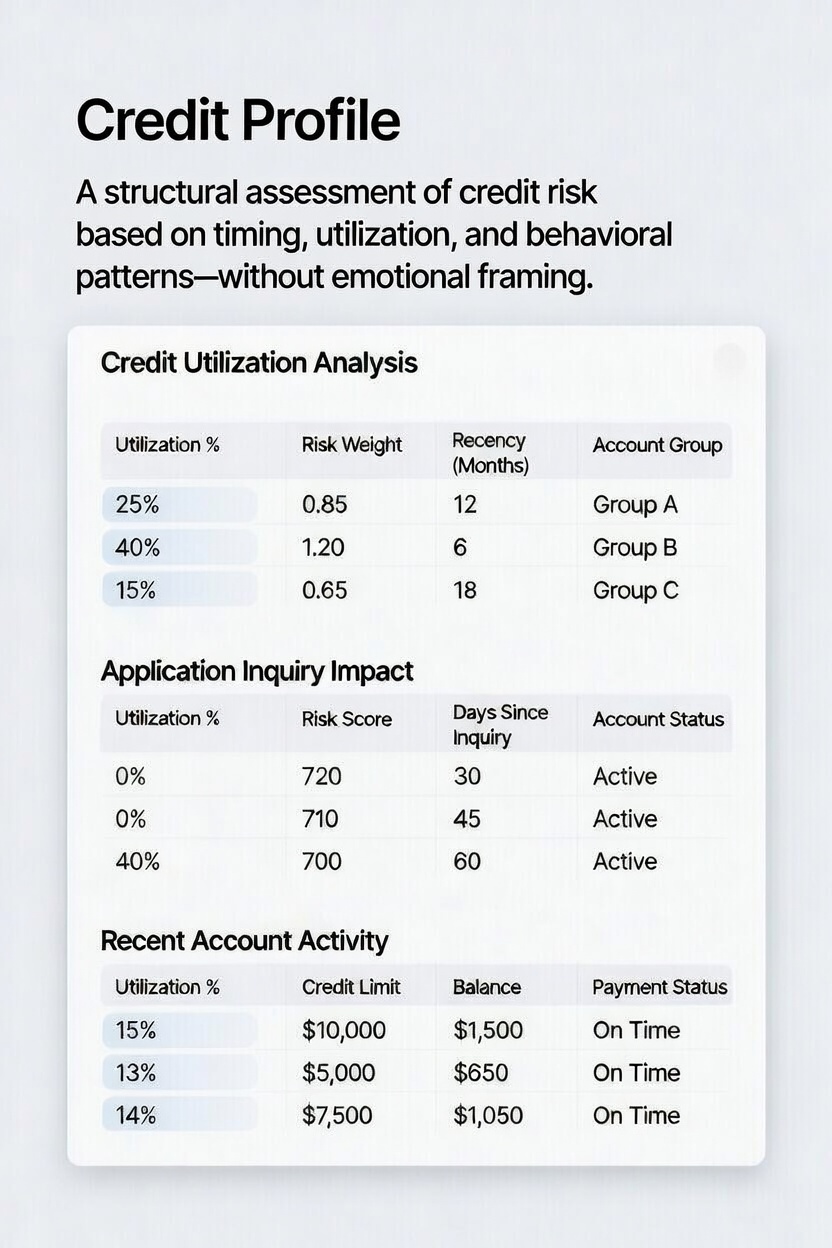

The profile includes:

Account age and history

Utilization behavior over time

Recent inquiries and applications

Account types and balance patterns

Timing of activity

Two people can have the same score and very different profiles.

Those differences are often what lenders care about most.

This distinction becomes especially important when profiles lack depth, which is why file structure—not just cleanliness—matters for approvals, as explained further in [How thin credit files affect approvals].

Credit Score vs Credit Profile and What Lenders Actually Evaluate

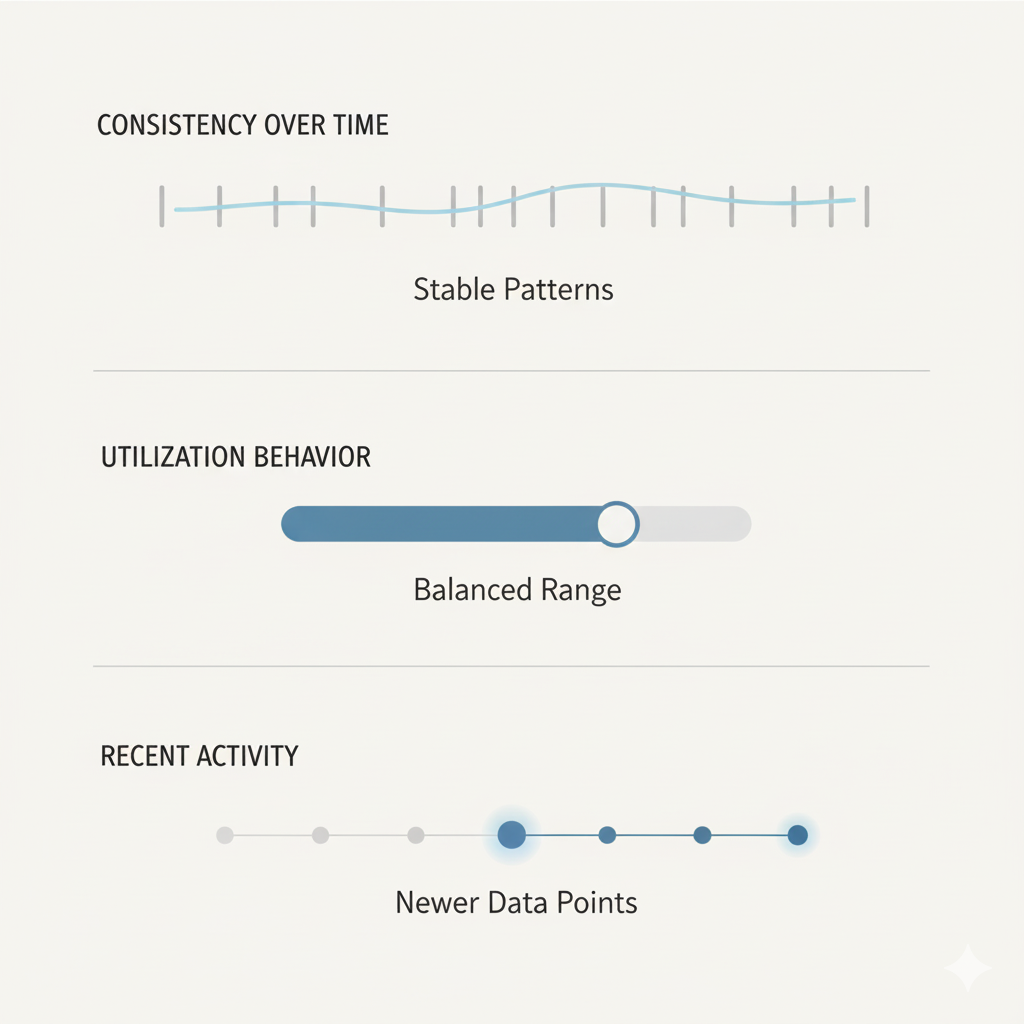

Credit score vs credit profile becomes clear when you understand lender priorities.

Lenders assess risk, not effort.

They look for predictability and stability.

They ask questions like:

Has this person been consistent

Do balances spike or stay controlled

Is recent activity calm or aggressive

Does the structure match the request

A high score paired with unstable behavior raises flags.

A moderate score with clean structure can outperform it.

Approvals are about alignment, not just qualification.

This is also why relying on a single account can be misleading, a misconception addressed more directly in [Is one credit card enough to build real credit history?].

Credit Score vs Credit Profile and the “Good Credit but Denied” Problem

Credit score vs credit profile explains why “good credit but denied” is common.

Denials are rarely random.

They are usually structural.

Common causes include:

Too many recent applications

High utilization before applying

Thin files with aggressive activity

Poor timing relative to the request

None of these are obvious if you are only watching your score.

This is why focusing on score improvement alone creates false confidence—and why understanding approval logic matters more than chasing points.

Credit Score vs Credit Profile and Why Timing Matters More Than You Think

Credit score vs credit profile is heavily influenced by timing.

Recent behavior carries more weight than older behavior.

Early-stage files are especially sensitive.

Applying at the wrong time can:

Reduce approval strength

Lower limits or worsen terms

Create denial patterns that linger

Waiting strategically is not avoidance.

It is positioning.

When beginners understand this, they stop reacting emotionally to score changes and start thinking in windows.

Credit Score vs Credit Profile and Social Media Advice

Credit score vs credit profile confusion is amplified by generic advice.

Most online tips are not stage-aware.

They assume a thick, seasoned profile.

What helps later can hurt earlier.

What raises a score short-term can weaken approvals long-term.

Without context, advice becomes noise.

Noise leads to over-action.

That over-action is one of the fastest ways to damage a beginner profile.

Credit Score vs Credit Profile and Building the Right Foundation

Credit score vs credit profile clarity changes how beginners build.

Instead of chasing points, they focus on:

Clean structure

Controlled utilization

Intentional timing

Fewer, better decisions

This mindset protects future options.

It also reduces anxiety.

If you want a foundational reference that explains how early decisions shape both score and profile, the Zero-to-Score Roadmap: Build Credit from Scratch – A Beginner’s Guide to a Strong Foundation in 30–60 Days provides clear education without overload.

You can access it here:

https://shop.beacons.ai/renaediazmiller/5284b7aa-485e-47d1-9a11-3c8d2e34dbe2

Credit Score vs Credit Profile and When to Get a Second Set of Eyes

Credit score vs credit profile becomes most important right before action.

If you are unsure whether your profile matches your goal, clarity matters more than speed.

A Credit Review + Action Plan (Limited Availability) can help identify whether your score aligns with your profile and whether timing or structure could weaken outcomes.

This is not about rushing applications.

It is about protecting them.

https://shop.beacons.ai/renaediazmiller/320df65f-400a-4a57-b1e6-35677a4e8c56

Credit Score vs Credit Profile Is the Difference Between Activity and Strategy

Credit score vs credit profile reframes how beginners think about credit entirely.

A score shows movement.

A profile shows readiness.

When you understand the difference, you stop chasing numbers and start protecting outcomes.

That shift is what leads to stronger approvals over time.

Credit score vs credit profile is not a small distinction.

It is the foundation of how approvals actually work.